Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is california instructions tax?

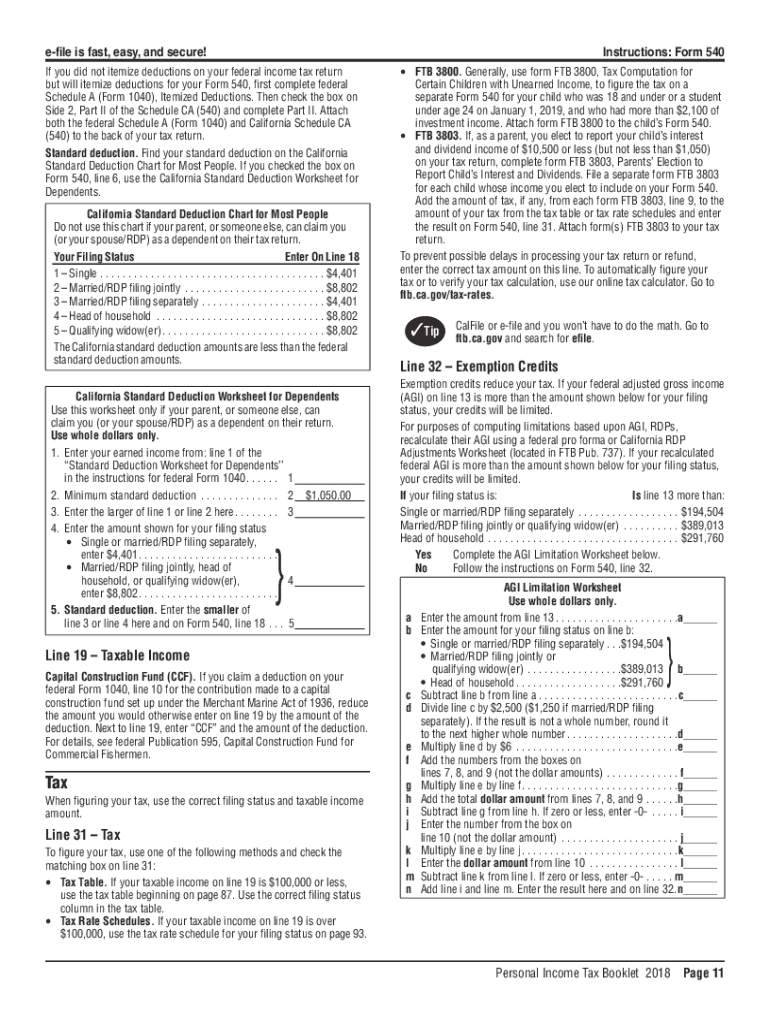

California state income tax is a progressive tax, meaning that higher income earners pay a higher rate. The current tax rate ranges from 1% for those with an adjusted gross income of $0 to 12.3% for those with an income of $1,000,000 or more. The tax brackets for California state income tax are as follows:

1% on the first $8,809 of taxable income

2% on taxable income between $8,810 and $20,883

4% on taxable income between $20,884 and $32,960

6% on taxable income between $32,961 and $45,753

8% on taxable income between $45,754 and $57,824

9.3% on taxable income between $57,825 and $295,373

10.3% on taxable income between $295,374 and $354,445

11.3% on taxable income between $354,446 and $590,742

12.3% on taxable income of $590,743 and above

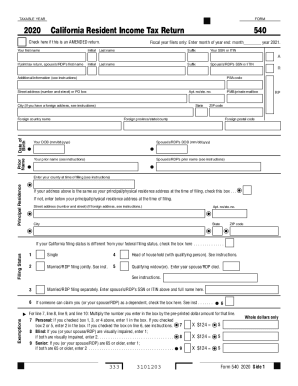

How to fill out california instructions tax?

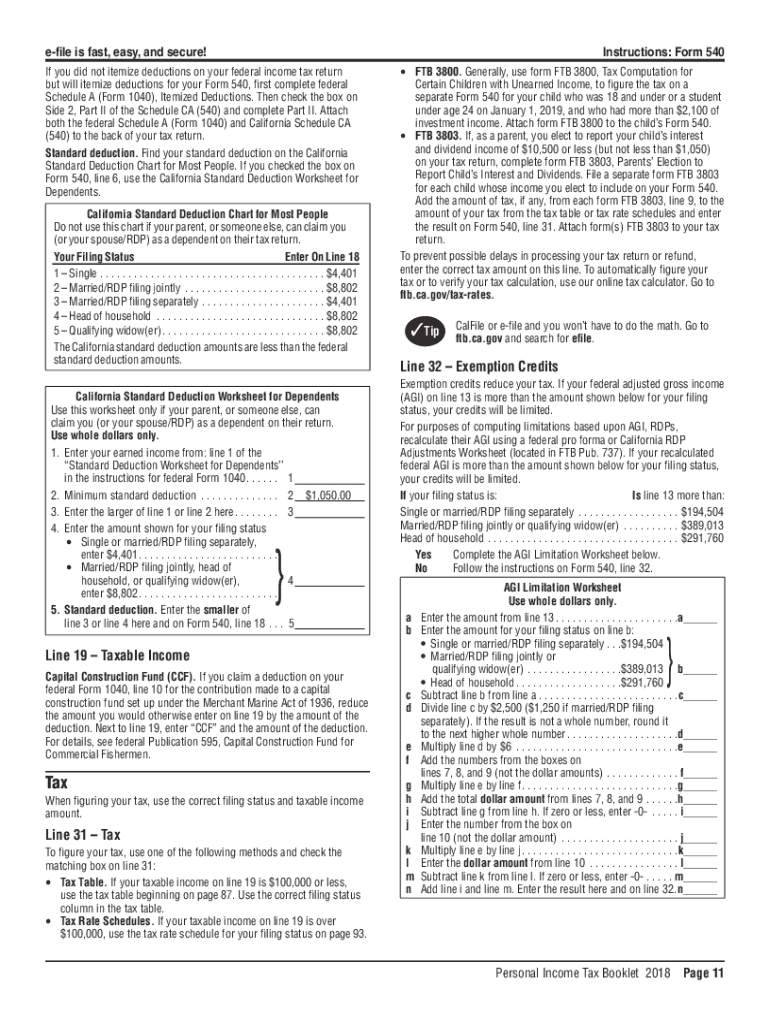

1. Gather your documents: You will need your W-2s, 1099s, and any other income documents.

2. Download the California tax return form: You can download the latest version of the California tax return form from the California Franchise Tax Board website.

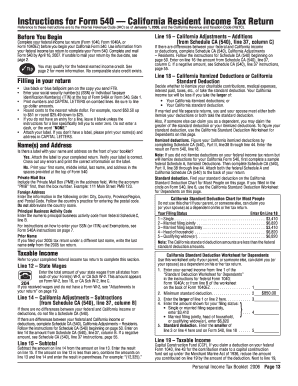

3. Enter your personal information: This includes your name, address, Social Security number, and filing status.

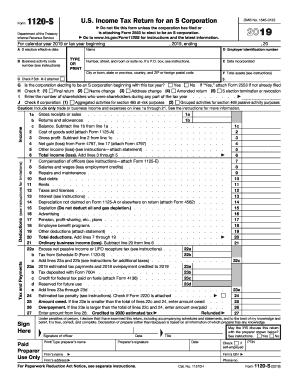

4. Enter your income: Include your wages, salary, tips, interest, dividends, and other income.

5. Calculate your deductions and credits: This includes the standard deduction, itemized deductions, credits for education and child care expenses, and any other allowable deductions.

6. Calculate your tax: Use the tax tables or the tax calculator provided on the California tax return form to calculate your tax liability.

7. Sign and mail your return: Sign and date your return, and mail it to the address provided on the form.

Who is required to file california instructions tax?

Individuals who meet the following criteria are required to file California state tax returns:

1. Residents of California who have a specific income threshold:

a. Single filers under the age of 65 with a gross income exceeding $18,105

b. Single filers aged 65 or older with a gross income exceeding $19,644

c. Married filing jointly under the age of 65 with a gross income exceeding $36,210

d. Married filing jointly aged 65 or older with a gross income exceeding $37,749

2. Non-residents of California who received any income from California sources, regardless of the income amount.

3. Part-year residents of California who either earned income in California or had income from California sources during the time they were a resident.

4. Individuals with self-employment income of $400 or more.

5. Individuals who had a withholding tax liability and wish to request a refund.

It is advisable to consult the California Franchise Tax Board (FTB) or a tax professional for specific circumstances and requirements to ensure accurate filing.

What is the purpose of california instructions tax?

The purpose of California instructions tax is to provide detailed instructions and guidelines for properly filing state tax returns for individuals and businesses in the state of California. These instructions provide taxpayers with specific information on how to accurately calculate their tax liability, claim deductions and credits, and comply with California tax laws and regulations. The instructions also help taxpayers understand their rights and responsibilities in relation to their state tax obligations.

What information must be reported on california instructions tax?

When filing California state taxes, the following information must be reported:

1. Personal Information: This includes your full name, social security number, and mailing address.

2. Filing Status: Indicate whether you are filing as single, married filing jointly, married filing separately, head of household, or qualifying widow(er) with dependent child.

3. Income: Report all sources of income, including wages, salaries, self-employment income, rental income, dividends, interest, retirement income, and any other taxable income received.

4. Adjustments: Deductible adjustments to income, such as self-employment tax, educator expenses, student loan interest, tuition and fees deduction, health savings account contribution, and others.

5. Credits: Claim any eligible tax credits, such as child tax credit, earned income credit, dependent care credit, residential energy credit, and others.

6. California Withholding: Report the total of California state income taxes withheld from your paychecks throughout the year.

7. Tax Payments and Refunds: If you made estimated tax payments, claim them on the form. If you are eligible for a refund from the previous year, report it as well.

8. Deductions: Calculate your deductions, including California standard deduction or itemized deductions (such as medical expenses, state and local taxes, mortgage interest, charitable contributions, etc.).

9. Health Insurance Coverage: Provide information on health insurance coverage for yourself and any dependents.

10. Tax Due or Refund: Determine your final tax liability or refund by subtracting your tax credits and deductions from your total tax liability.

Additionally, it is important to note that California tax laws and forms are subject to change, so it is always recommended to refer to the official California Franchise Tax Board (FTB) instructions and publications for the most accurate and up-to-date information.

What is the penalty for the late filing of california instructions tax?

The penalty for the late filing of California state income tax can vary depending on the circumstances. Generally, if you fail to file or pay your California state income tax by the due date, you may be subject to penalties and interest.

The late filing penalty is usually 5% of the unpaid tax amount for each month (or part thereof) that the return is late, up to a maximum of 25% of the unpaid tax. Additionally, if you do not pay the taxes owed by the due date, you may also be subject to a late payment penalty of 0.5% of the unpaid tax amount for each month (or part thereof) that the tax is not paid, up to a maximum of 25% of the unpaid tax.

It's important to note that these penalties can add up quickly, so it's generally recommended to file and pay your California state income taxes on time to avoid these penalties.

How can I send california instructions tax for eSignature?

When your california instructions pdf form is finished, send it to recipients securely and gather eSignatures with pdfFiller. You may email, text, fax, mail, or notarize a PDF straight from your account. Create an account today to test it.

How do I complete california instructions sample on an iOS device?

Get and install the pdfFiller application for iOS. Next, open the app and log in or create an account to get access to all of the solution’s editing features. To open your california 540 instructions tax, upload it from your device or cloud storage, or enter the document URL. After you complete all of the required fields within the document and eSign it (if that is needed), you can save it or share it with others.

How do I edit ca 540 instructions on an Android device?

You can make any changes to PDF files, like california 540 instructions form, with the help of the pdfFiller Android app. Edit, sign, and send documents right from your phone or tablet. You can use the app to make document management easier wherever you are.